CARES Act Info For Home Service Companies

Applications Begin April 3, 2020

Here's what your plumbing or HVAC shop needs to know.

- Paycheck Protection Program (PPP). Information sheet here. Application here.

- Economic Injury Disaster Loan (EIDL) Apply here.

- Designed by the SBA, but funded by banks

- Apply through any SBA lender

- 2-page application – very lax on information required compared to normal loan standards

- No Guarantees, No Collateral Required

- Forgivable if you meet the same Employee Count on June 30th , 2020

- Business gets to choose the date that best suits their situation – the number of employees on

- Either February 15, 2020 or Date of the Loan

- Must have same number of employees on June 30th

- If business has “laid them off” so the employee can file unemployment, the business can hire them back.

- Calculated on 2.5 months of “fully loaded payroll expenses” and 25% of rent/mortgage interest (not principal) and utilities for that 8-week period

- “Fully loaded payroll expenses” include vacation, healthcare costs, taxes, owner’s salary (if on payroll and only up to $100K)

- Uses of Loan – if the loan is used for these then the loan will be “forgiven”: Rent/Mortgage, Utilities, Pre-existing debt

- **SPOILER** This program uses your Form 941s for the previous 12 months in it's calculation. If you're a sole proprietor that was not on payroll, or if you did not have much payroll expenses during 2019, you will find this program may not be advantageous for you.

- Funded by SBA. Apply at sba.gov

- This is a loan and not “forgivable”.

- This is to “compensate for losses” for the business. If PPP funds are received, those expenses CANNOT be included in the “losses” amount. There is NO DOUBLE DIPPING!

- The normal loan approval standards are going to be very lax on this program.

- Amount of loss

- Determined by the SBA when comparing 2019 12 months of sales to 2020’s first few months of sales.

- February 15th – June 30th are the dates that loss will be calculated.

- SBA will determine the loss calculation for the loan amount.

- The business owner can interject that a large job was lost due to closures, etc.

- Terms:

- 4% interest (but Treasury Department is saying only .5% interest).

- Up to 4 years of payment deferral

- Up to 30-year term

- No Guarantees, No Collateral up to $200,000

- Can get “grant” advances up to $10,000 within 3 business days

- Must apply for the loan and ask for the advance of $10,000.

- If the SBA approves this $10,000 and the applicant gets denied the loan, the applicant does not have to pay it back….it becomes a grant.

- Paperwork/Documents to have ready:

- Tax Documents (2019’s can be influx)

- Signed IRS Form -T

- Personal Financial Statement (SBA Form 413)

- Schedule of Liabilities (SBA Form 2022)

- 2019/20 Balance Sheets and Profit & Loss Statements

- “Payroll” calculations

- Employee counts of number in place and plan to retain same amount

- Lease/Mortgage and utility costs

- Ownership Info – who owns what percentage

- Information is not for guarantee purposes but in case of fraud

DO NOT APPLY MULTIPLE TIMES.

Things are moving quickly, and details are still emerging.

Was This Helpful?

Sign up here, and we'll automatically email you as we publish new articles that you may find useful.

Was This Helpful?

As Seen In:

Is your website helping or hurting your SEO efforts? Find out now for free.

We've got give-a-damn for days.

When my team talks with new clients, we hear a ton of frustration, overwhelm, and general fed-up-ness.

I'm guessing you can relate.

Maybe you've been trying to figure out all this marketing stuff on your own OR you've handed a crap-ton of money to an "expert" for no apparent reason.

Your phones still aren't ringing like they should.

Your advertising still isn't performing like you expected.

Your website's still not ranking or converting like it needs to.

You can't figure out why... and/or your current marketing "partner" isn't 'fessing up.

We think you deserve better.

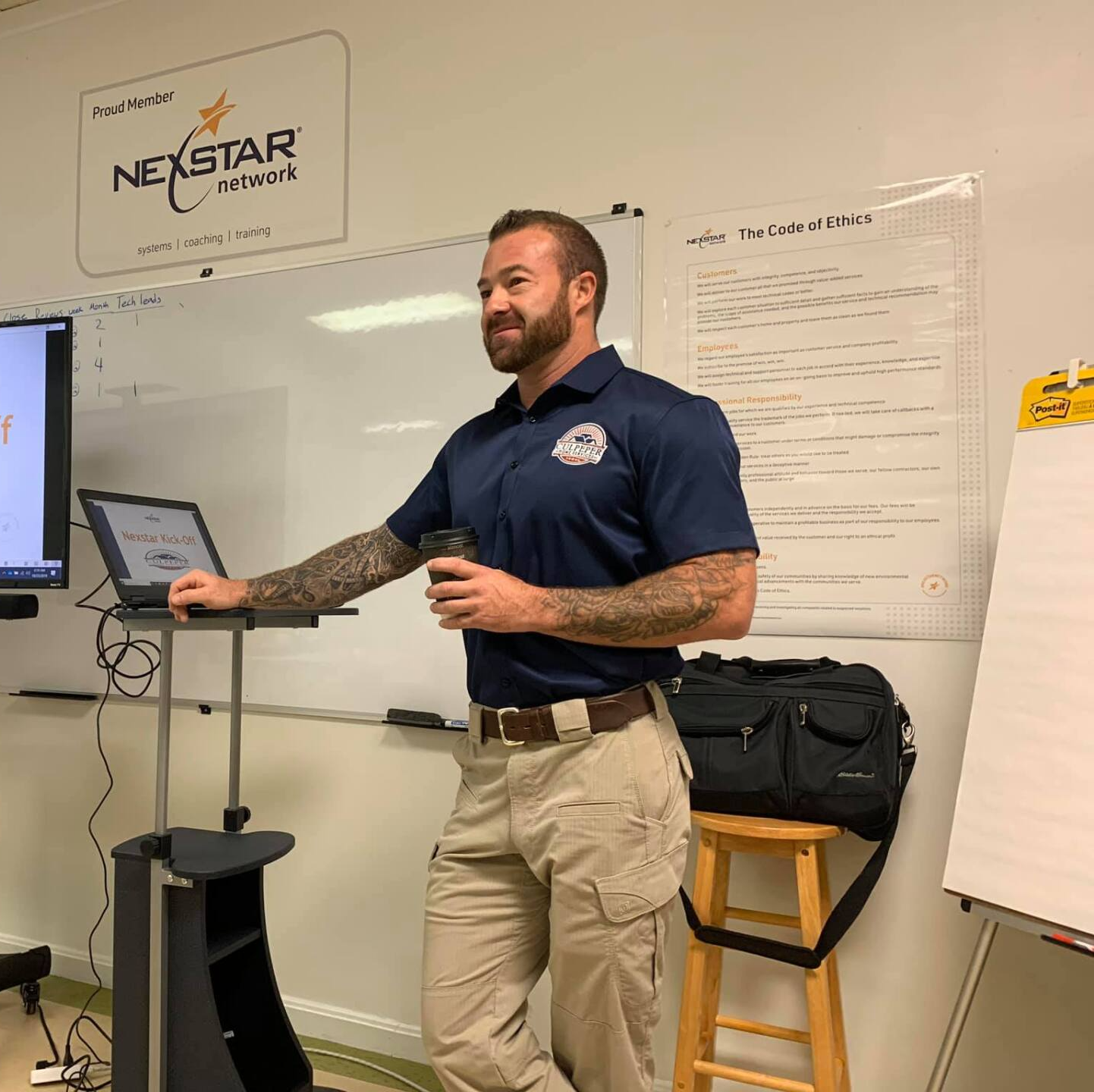

Ryan Redding

CEO Levergy

Author of The Book on Digital Marketing for Plumbing and HVAC Contractors

Here's how we'll get you more plumbing, HVAC, electrical, garage door, roofing, or other home service leads:

Tell us what's keeping you up at night.

Let's get on a call so you can tell us where your business is and where you want to go. We'll follow-up with a free, comprehensive assessment and actionable tips.

We'll help you fix it.

If you like what you see so far, we'll put together a customized plan with transparent, flat-rate pricing—and then get to work growing your business.

So you can breathe easy.

Have peace of mind knowing you have a true partner on your side who cares about your success as much as you do.

What you get is important.

How you're treated is what sets us apart.

Culpeper Home Services

"... they always go above and beyond the call of duty. I'm impressed with their work ethic, loyalty, and integrity."

- Russell Furr, President

The Clog Dawg

"[Levergy] understood my specific needs and got the work done—bypassing all the unnecessary nonsense. And now business is booming!"

- Steven Douglass, President

Your mileage may vary.

Better results are here.

Discover how to stop wasting money on marketing that doesn't work, and make your phone ring off the hook.